The Attitude Small Caps investment fund closes its first year with 6.10% since February 22, 2023.

Let's review the end of the 2023 year and the last quarter Q4.

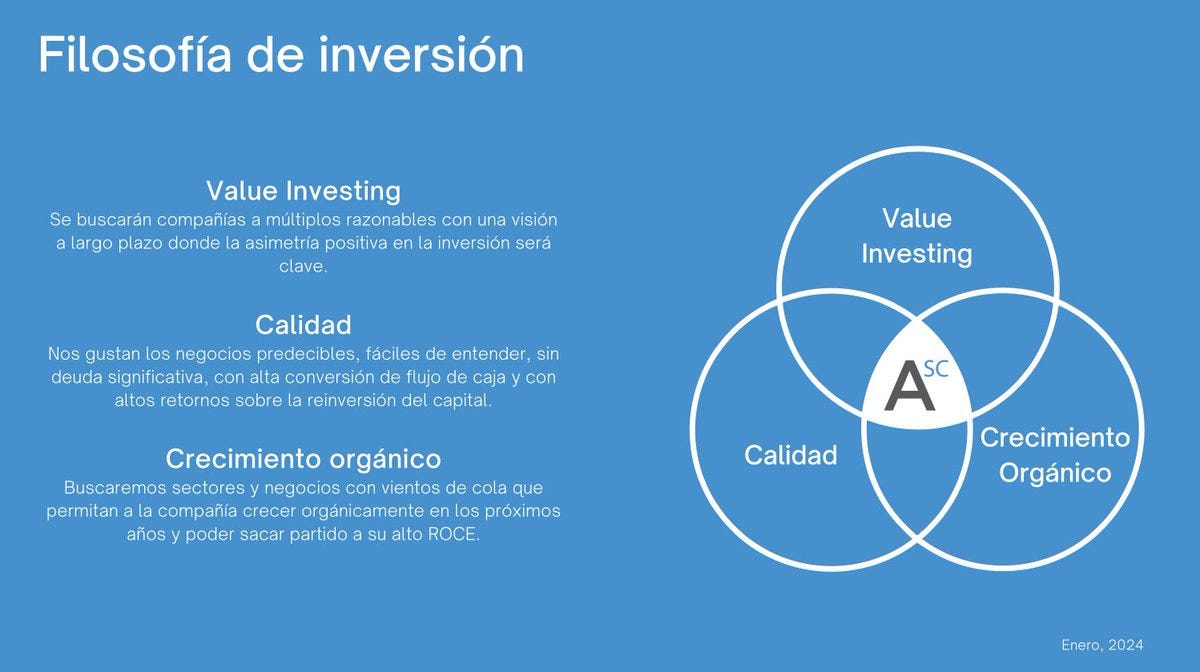

Investment Philosophy

As you already know, every quarter we summarize our investment philosophy in 3 pillars:

🔹Value Investing

🔹Quality y ROIC

🔹Organic Growth

In the small caps niche, we find it much easier to find opportunities that cover these three pillars.

First of all, we would like to thank our investors for their trust; without them, this project would not have been possible.

Also, to the investment communities like LocosWallStreet, ValueInvestingS, ClubdelValue, MomentumFinanc3, that have made our project known.

Markets

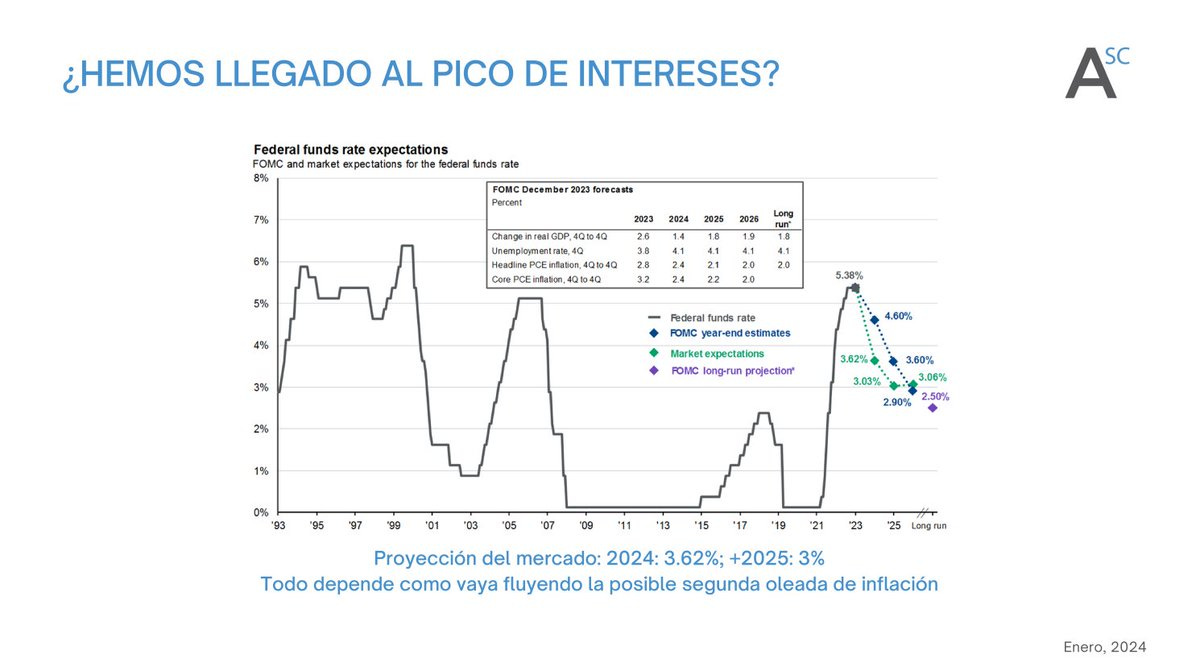

🔹Lower interest rates: It seems that there is a consensus that we have reached peak interest rates. A decrease is expected in 2024 but a normalized interest at +2025 of 3%, a scenario that would be very different from that experienced in the last decade.

🔹The USA is no longer the leader: After 14 years of leading the rest of the regions, it has been 2 years since the rest of the developed regions have had, timidly, a better performance. we are if it continues.

This US leadership has not only come from economic growth but from a higher multiple that seems to be reaching its ceiling.

🔹Small Caps very undervalued: As we have previously commented, the mall cap theme is not fashionable, and there is a significant divergence in valuation even within the USA.

How do we position ourselves in this market at Attitude Small Caps?

We invest in small caps at minimum valuations.

We look for small caps in regions that are not in fashion, the US (55%) & Asia (30%).

We have no preference over Value or Growth, we invest in companies that fulfill both.

Results

🔹We closed the year with a 6.10% profitability, compared to 4.27% for our benchmark index, MSCI World Small Caps Total Net Return €.

🔹In contrast, the MSCI World achieved 13.33%, there is a clear divergence in profitability between large and small companies.

* Fund launch: 02/22/2023

A couple of details about the year: January and February were 2 very good months for Small Caps and for Europe, profitability that the fund could not collect, unfortunately.

On the other hand, it is interesting to see the poor performance of the Hang Seng, which has fallen 17%. Let's remember that the fund has 30% exposure to Asia.

This analysis of the profitability of the indices can be felt in our companies.

If we take the mid-big caps that are in the fund, we will see that in the 3 cases the profitability over the year in these companies has been much better than that of the fund.

On the other hand, our Asian portfolio has meant a total loss for the fund of 2.6%, which has been partially mitigated thanks to the high dividend yield we have.

In terms of share price, the drop has been around 9% (2.6%/30%). Currently our Asian portfolio has more than 8% dividend yield.

Rating of the year

As a final evaluation of the year I would like to highlight 4 points:

🔹Happy with the profitability: I think it is a year to be happy. Our objective has always been to compound above 7.5% annualized, and we have stayed close at 10 existence esses (6.2%). Furthermore, we have managed to beat our reference index. Even with everyone, we know that the background has only been filmed for a few months, and it is still too early to draw conclusions.

🔹Year of learning and sowing: The first year of any project is always learning. The analysis is done and we have 30 companies that we know very well. The seeds are sown and you need to be patient and wait to harvest.

🔹Low volatility: Although it is not something that we pay special attention to, we have had quite good volatility compared to the index; our maximum drop has been 5% compared to 10% of the reference index.

🔹Low turnover: We have had low portfolio turnover, with no exit from our presented and invested companies. This is in line with our philosophy of conviction, analysis and patience.

Portfolio composition

Variable income (98%)

🔹Focus on Europe (55%) and Asia (30%): As we have explained before, we are in those regions where there is greater opportunity and they are not fashionable.

🔹Focus on small companies (86%): Given the size of our fund, we reach especially small companies that no one follows or analyzes.

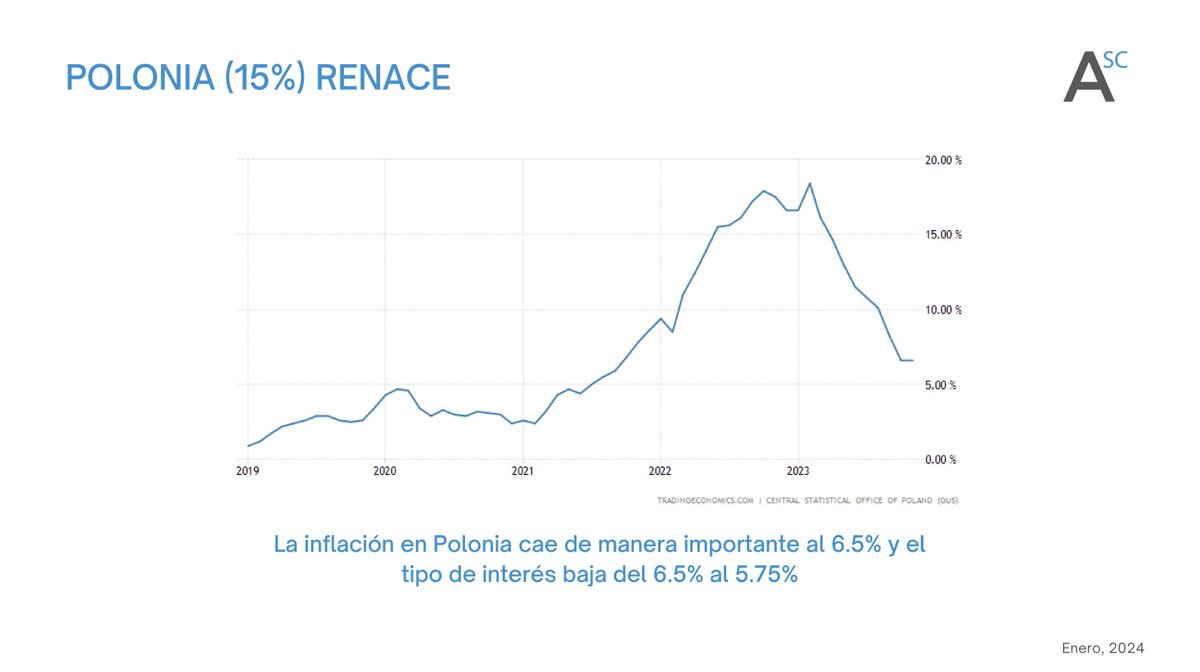

🔹Poland is reborn: As you know, we have a significant exposure in Poland, 15%, through the investment in Toya and Delko. Both companies have performed well, since the drop in inflation has motivated investors to invest again in the country.

Inflation has fallen from 18% to 6.5% and the central bank has lowered interest rates by 5% to 5.75% given the good inflation prospects.

🔹Asia reopens: In the case of Asia, we have seen improvement across the region. Visitors to Hong Kong have increased to 50% of the pre-COVID total. There is still room for improvement but the trend is clear.

🔹We are seeing significant share purchases by the owners of our Asian companies. Peter Lynch has always commented: "There are many reasons why a company's dream company sells shares, but only one reason why they buy them, they believe that the price of the share will rise."

Options strategy (3% nominal)

🔹Nagarro (March 2024): We have sold an option to buy Nagarro at €52, we would be interested at this price in increasing our position. On the other hand, we currently have 4% exposure to Nagarro, and we have sold an option to sell Nagarro for €84, that is, we are interested in selling the company as it rises.

This "pendulum" strategy seems very interesting to us and matches our philosophy: The greater the potential, the greater the exposure, the lower the potential, the less exposure.

Top10 ideas of the Portfolio

🔹We have a 52.7% in our 10 most important ideas.

🔹It is worth highlighting the high exposure to Toya with 9.3%, where we have not sold any shares despite the good performance, since it has, in our opinion, very significant potential.

New position: Ten Pao (2%)

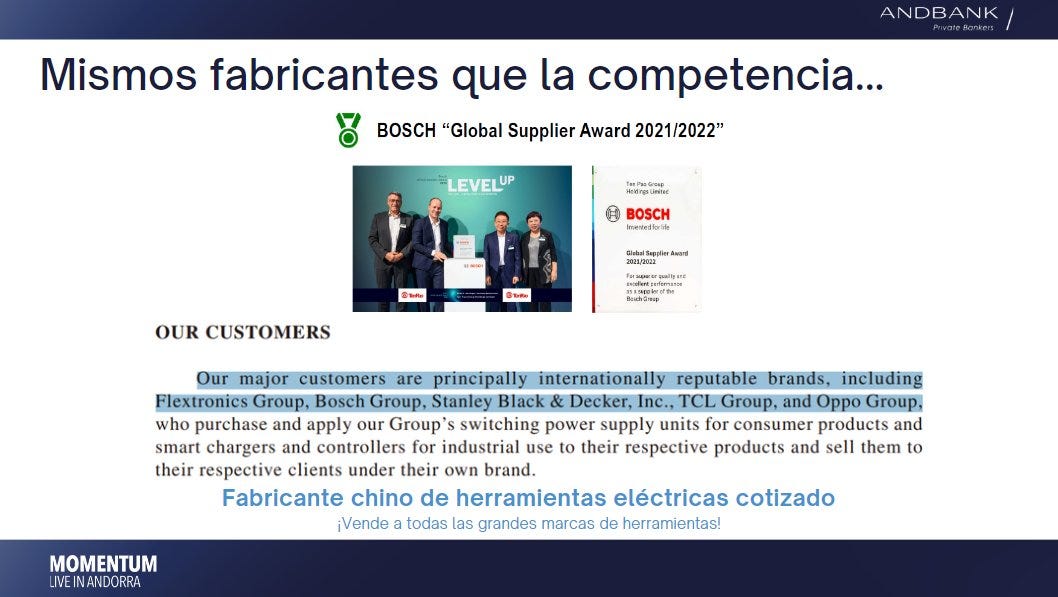

As a result of analyzing Toya and its competitors (Bosch, Makita, Stanley, etc.), I had doubts about the differentiation between products (all of them outsource production to Asia).

Searching through Google, I found a couple of companies, including Ten Pao, which is dedicated to manufacturing power and industrial tool chargers for the ENTIRE sector.

I was able to tell about this discovery at the @MomentumFinanc3 event in Andorra, where I presented Toya's thesis.

When investing in Ten Pao, we found a company that meets our 3 pillars:

🔹Value Investing: At 4-5 times normalized profit. Dividend of 6% despite growing double digit.

🔹Quality: Despite being a manufacturer, there is a crucial leg in the business, which is R&D (around 3% of sales). Ten Pao designs and customizes chargers to its client and final product, it is not a typical commodity manufacturer. On the other hand, your clients have an important history. It also has a normalized ROE above 20% without using euda.

🔹Organic growth: Every year Ten Pao gains more clients, new geographies and new products. Historically, it has been able to grow at double digits and continues to increase its production capacity.

What happens to the company?

🔹In the short term, there is excess inventory in its different product segments. However, given the margins and good business, the company continues to generate significant profits.

🔹The market is afraid of China and especially manufacturing. However, the final client is mostly outside of China and when we talk to Ten Pao's client, they tell us that it is impossible to leave China, due to the "know-how" compared to Vietnam or comparable. Despite this, Ten Pao is accompanying its clients if they want to move the manufacturing abroad, having a presence in Vietnam, Hungary, and Mexico. It seems to us that the market fear is quite mitigated in Ten Pao.

This is the thread for the last quarter and the year 2023.

If you like that I make these summaries, we would appreciate your sharing the thread.

Thank you very much, and happy start to 2024, where great things will surely be in store for us.

RV

Link to our video presentation (In Spanish):